Make a splash this June!

Get on board and make waves with your newfound skills and learnings with our Summer Sale!

Introduction

Gold Edge are pioneers in advanced online training that focusses on the individuality of the learner. We recognise that for every student to succeed, a variety of resource options need to be made available depending on learning style, giving them the opportunity to learn ‘how they learn best.’

Study accounting from £615 and bookkeeping from £325The AAT door is open to all learners NO ENTRY REQUIREMENTS just a good command of maths and english

AAT Level 2

- No prior accounting knowledge necessary

- Best option for most beginner students

- Build your foundation knowledge in Accounting

AAT Level 3

To start Level 3, you will need to have achieved one of the following:

- Passed AAT Foundation level 2

- A pass in an equivalent level 2 accounting qualification

- An A-Level in accounts

- Accounting experience in excess of 2 years

- A good understanding of manual double entry bookkeeping

AAT Level 4

To start Level 4, you will need to have achieved one of the following:

- Passed AAT Foundation level 3

- A full accountancy or finance degree*

- 10 or more years of diverse and varied experience at middle to senior level

*If your degree is in banking or financial services, please call us on 02394 00 3559 to find out if Level 4 is suitable for you.

Enquire now to find out moreHigh-End Teaching & Support

Our aim is to interact with you and be a part of your learning, removing the distance from your remote learning. We want to know how your study is progressing the same way as if you were attending college.

Easy to Contact Team

Qualified study coaches

Four stages of revision to ensure you are exam-ready

We track your studies and keep you motivated

Experienced and professional teachers

All these pillars of support ultimately lead to your success

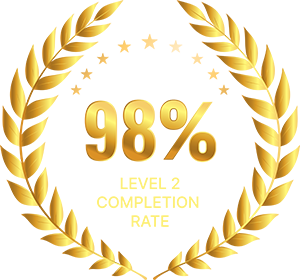

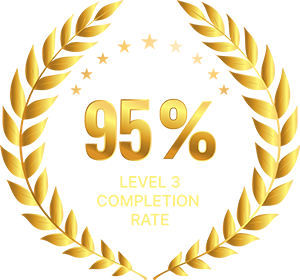

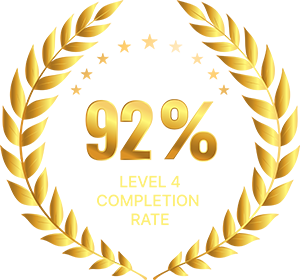

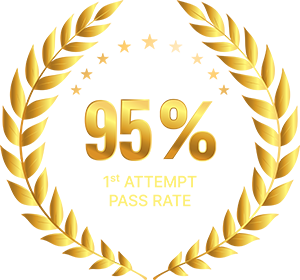

TOP EXAM RESULTS

OUR STUDENT SUCCESS IS SECOND TO NONE

Not only are Gold Edge students individually high achievers, as a group, they top the charts for percentage of students completed. Even better, most of the exam passes achieved, are first time passes. For accuracy of actual students passed, the results below remove the 5% of student exam results that were initially fails. Their subsequent passes are included

AVERAGE PERCENTAGE OF STUDENTS PASSED AT FOUNDATION LEVEL 2 Q2022

AVERAGE PERCENTAGE OF STUDENTS PASSED AT FOUNDATION LEVEL 3 Q2022

AVERAGE PERCENTAGE OF STUDENTS PASSED AT FOUNDATION LEVEL 4 Q2022

PERCENTAGE OF STUDENTS PASSED AT THE FIRST ATTEMPT ACROSS ALL LEVELS

* The following AAT published national average pass rates do not remove the failed exam results of students who initially failed before going on to pass. This means that any second attempt passes are not recognised because they are offset by the result of their original failure.

AAT current worldwide average pass rates with failures included *Level 2 -75% Level 3 -58% Level 4 -63%

Gold Edge Training comparable pass rates with with failures included Level 2 -95% Level 3 -80% Level 4 -85%